Archive for the ‘Sick Pay’ Category

CALIFORNIA CORONAVIRUS RESPONSE, UPDATED

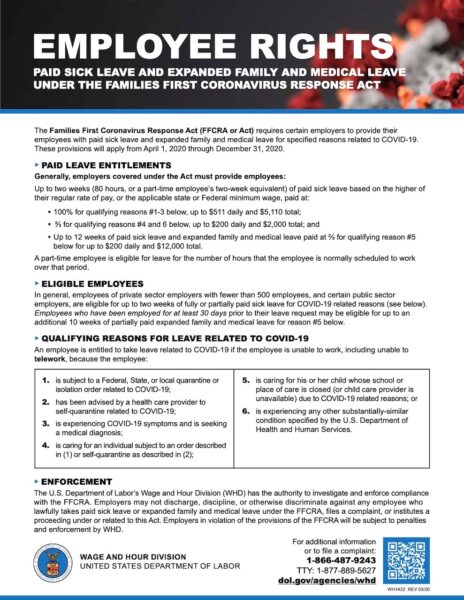

Cities and Counties Requiring Paid Sick Leave Above and Beyond Federal Limits The federal Families First Coronavirus Response Act (FFCRA) requires most businesses with fewer than 500 employees to provide emergency paid sick leave benefits for workers affected by COVID-19. For example, covered employers must provide 80 hours of paid sick leave for full-time employees and two weeks of […]

KEEP IT TO YOURSELF

Essential Workers Must Cover Up and Stay Six Feet Apart Facing COVID-19’s unfolding (sur)realities, LA City, LA County, Pasadena and Riverside County, among other local California public health authorities, have ordered that wear-a-mask and six-foot distance “recommendations” are now mandatory whenever possible for workers at essential businesses. Effective April 10, a City of Los Angeles […]

IT’S A WASH

COVID-19 Paid Leave and Tax Credits As reported in Federal Coronavirus Workplace Relief (March 23) and COVID-19 Gets Noticed (April 2) the March 18 Families First Coronavirus Response Act (FFCRA) requires most employers with fewer than 500 on payroll to provide paid sick and family leave wages for certain COVID 19-related absences. The FFCRA includes […]

COVID-19 GETS NOTICED

As reported in “Federal Coronavirus Workplace Relief,” the March 18 Families First Coronavirus Response Act (FFCRA) contains two nationwide employee leave laws, the Emergency Paid Sick Leave Act (PSL Act) and the Emergency Family and Medical Leave Expansion Act (EFMLA). In essence and applicable to businesses with fewer than 500 employees: The PSL Act requires […]

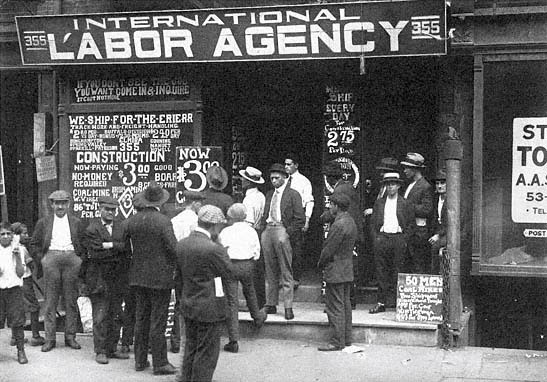

UNEMPLOYMENT GOES VIRAL

Furlough Versus Layoff: A Distinction Without a Difference? The Coronavirus crisis has forced many employers to reduce or eliminate their work force for the foreseeable future. Some employers are characterizing such action as a temporary “furlough.” Others are framing such action as a “lay off” for the time being, until the calamity passes. Yet, for […]

FEDERAL CORONAVIRUS WORKPLACE RELIEF

New Paid Sick Leave, Family Leave and Tax Credits Effective April 2, 2020 On March 18, President Trump approved several coronavirus emergency measures for employees and employers, portions of the Families First Coronavirus Response Act (Act). Two sections enhance worker leave (or “furlough”) benefits. The Emergency Paid Sick Leave Act (PSL Act) provides a new nationwide […]

HOLDING FIRM

As a close observer of the 2014-2015 Ebola outbreak from my West African work, the most precious commodity in the current pandemic is knowledge. Please consider this eight-minute COVID-19 video for a concrete understanding of the actual challenge we all face and the simple actions necessary to place this ordeal firmly in the rear view […]

TELECOMMUTING IN RESPONSE TO CORONAVIRUS OUTBREAK

Employers are taking various steps to help offset the economic repercussions of the Coronavirus pandemic, such as providing employees with the use of paid sick leave, paid vacation time, and telecommuting. A well-written telecommuting policy permits managers and rank-and-file workers alike to know where they stand. It should minimally address these points: Identifying the equipment […]

WHAT’S NEW IN 2020 ORGAN DONOR LEAVE EXPANDED

Effective January 1, 2020 California law requires employers with 15 or more on payroll to provide paid organ donor leave to any employee undergoing such procedures. Beginning January 1, 2020, employers must also provide additional unpaid time off up to a total of 30 business days for organ donor leave. Thus, any employee undergoing an […]

WHAT’S NEW IN 2020 CALIFORNIA MINIMUM WAGE RATES

On January 1, 2020, California minimum wage will increase to $12.00 for small employers with 25 or fewer employees and to $13.00 per hour for larger employers with 26 or more employees. These rates continue to increase annually until they reach $15.00 per hour in 2022 for larger employers and in 2023 for those with […]